Videos – Credit Report Errors

Adjudication on the merits means debt collector who sued you cannot credit report on you or continue to collect against you!

So you have been sued by a debt collector (or even an original creditor). You get the case dismissed with prejudice and then the collector (or creditor) is still collecting against you. Is this legal or illegal? What in the world does the expression “adjudication on the merits” mean for you (hint: its a good thing!). Possibilities when you are sued by a collector in a collection lawsuit Judgment for plaintiff (the one who sued you) Judgment for defendant (you… (Read more)

After you answer a debt collection lawsuit what should your credit report show?

After you answer a debt collection lawsuit what should your credit report show? Once you’ve been sued by a debt buyer such as Midland Funding, Portfolio Recovery, or LVNV, and you’ve filed an answer, what should your credit report show? It’s excellent that you’ve answered the lawsuit. Most people fail to respond, which can be detrimental to you. So what should the credit report show about this debt buyer? There are a few important things to look for when reviewing… (Read more)

What happens with your credit report after you win your collection trial?

What happens with your credit report after you win your collection trial? When you are in court and you win, what happens with your credit report after the trial? You want the debt removed from your report, but how does this happen? Do you ask the judge? Does this happen automatically? In this post, we’ll discuss how to wrap things up after you win. You’ve won your court case. What happens with your credit report now? The judge does not… (Read more)

Alabama foreclosure: What you should look for in your credit reports to help stop the foreclosure

Alabama foreclosure: What you should look for in your credit reports to help stop the foreclosure You’re facing a foreclosure in Alabama. What should you look for in your credit reports to help you stop the foreclosure? These suggestions are specific to Alabama. Your state may be similar, but you will want to check on your state’s laws. Does your credit report show that you are in foreclosure? This is very common on credit reports. As you approach a foreclosure… (Read more)

What happens with credit reporting after you win your collection trial?

What happens with credit reporting after you win your collection trial? When you are in court and you win, what happens with your credit reporting after the trial? You want the debt removed from your report, but how does this happen? Do you ask the judge? Does this happen automatically? In this post, we’ll discuss how to wrap things up after you win. You go to court and you win your case. What happens now? The judge does not control your… (Read more)

Why do credit bureaus believe furnishers over consumers?

Why do credit bureaus believe furnishers over consumers? Today, I wanted to talk with you about why do credit bureaus believe the creditor, or the debt collector, or a “furnisher” over you when you do a dispute? You believe there’s something wrong with your credit report. So, you reach out to the credit bureaus (TransUnion, Equifax, Experian) and tell them there is a problem with your Capital One account, your Portfolio Recovery account, or other debt collection account. You tell… (Read more)

Example: Suing a debt collector for updating balance after pay for delete

Example: Suing a debt collector for updating balance after pay for delete Today, I wanted to share with you an example of a case we filed in the context of a pay for delete. This is just one of the many cases we file against debt collectors for violating the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA). What is a pay for delete? A pay for delete is when you call up a debt… (Read more)

The critical difference between deleting a debt and killing a debt

The critical difference between deleting a debt from your credit report and killing a debt Deleting a debt from your credit report is good, but the debt still lives. You can still be sued and the debt can be sold. Think of it as a table with an object resting on top. The debt is the table and the credit report is on top of the table. If we can get rid of the credit reporting, excellent. But the table,… (Read more)

Can you really get mental anguish for false credit reporting against a debt collector?

Can you really get mental anguish for false credit reporting against a debt collector? When we sue for false credit reporting, we almost always make a claim for mental anguish. We have been suing debt collectors (Midland Funding, LVNV, Portfolio Recovery), credit bureaus (TransUnion, Equifax, Experian), and companies that furnish information to these credit bureaus for false credit reporting for many years. In every single case, the defense lawyers come back to us and say, “We didn’t do anything wrong,… (Read more)

FCRA credit reporting: examples of technical accuracy

FCRA credit reporting: examples of technical accuracy A lot of times when we sue credit reporting agencies (Equifax, TransUnion, Experian) or furnishers (companies who provide information to the credit bureaus) under the Fair Credit Reporting Act (FCRA), they love to say “Well, yeah, but you know this is technically right. It might be a little deceptive, but it is technically right.” There are ways to argue against this. We can flip this argument over on them. Here are some examples… (Read more)

Two reasons to pull your credit reports after beating a collection suit

Two reasons to pull your credit reports after beating a collection suit You’ve been sued by a debt collector or debt buyer such as Midland Funding, LVNV, Portfolio Recovery, and you’ve won your case. What do you do next? Pull your credit reports. Hopefully, you have looked at your credit reports before you get to the end of your lawsuit. Even if you haven’t, go on and pull them now. Whether you just won your suit yesterday or you won… (Read more)

General breakdown of the 5 categories FICO looks at for your credit score

General breakdown of the 5 categories FICO looks at for your credit score FICO is the dominant credit scoring model in the country used to determine eligibility for mortgages, auto loans, credit cards, and more. There are 5 categories used by FICO to determine your credit score: Payment History Amount / Utilization of your debt Age of debt Number of inquiries Mix of debt In this article, we will provide a brief overview of these categories and what they mean. … (Read more)

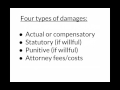

4 Types of money damages you can recover under the FCRA

4 Types of money damages you can recover under the FCRA What type of damages can you get from an FCRA lawsuit? There are 4 types of damages you can recover when suing under the FCRA: Mental Anguish / Emotional Distress Economic Statutory Punitive Mental Anguish There is false credit reporting and you have the ability to sue. Typically this means you have done a dispute through the credit bureau and it doesn’t get fixed. Now, this false credit… (Read more)

Two enclosures that should be mailed with your FCRA dispute letter to a credit bureau

Two enclosures that should be mailed with your FCRA dispute letter to a credit bureau There are two things you should include in any dispute letter a credit bureau (TransUnion, Equifax, etc.) Driver’s license or another form of government ID. Recent bill or statement that shows your name, address, and the company name. Why should you include these items if they aren’t required? Credit bureaus hate investigating claims. They don’t make any money from investigating claims. So, we are trying… (Read more)

My frustration with disputes people make to credit reporting agencies

My frustration with disputes people make to credit reporting agencies I have been suing credit bureaus and furnishers (companies that provide your information to credit reporting agencies) for about 20 years. During these twenty years, I encounter a frustrating mistake which is made far too often. I want to share this frustration with you so that you can avoid the same mistake. Here’s the situation: I am contacted by a credit repair place, the client of a credit repair place,… (Read more)

Is it legal for a creditor to pull my credit reports after settling with them?

Is it legal for an original creditor to pull my credit reports after settling with them? Let’s say you’re being sued by an original creditor, Capital One, for $10,000. You settle for $5,000. Once this has been settled, Capital One should show the balance as $0. You no longer owe them anything. If they leave it at $10k, that’s false credit reporting. If they listed the balance as $5,000 (the difference between the original amount and the amount of the… (Read more)

Charge off: How to get one removed from your credit reports by looking for factual errors

Charge off: How to get one removed from your credit reports by looking for factual errors We’ve talked about charge off debts in the past: What is a charge off? Can I be sued for a charge off debt? 3 things a creditor can do with a charge off Now, let’s talk about how to remove a charge off from your credit report. A charge off is the same as any other negative information on your credit report. You want… (Read more)

Credit reports: The original creditor and debt collector are both on my report – is this legal?

Credit reports: The original creditor and debt collector are both on my report – is this legal? How is your debt showing up on your credit reports? Let’s say I owe Discover $5,000 and this debt shows on my credit reports as $5,000 owed to Discover. Since my credit reports are accurate, I don’t need to worry about it. Discover may send the $5,000 debt to a debt collector. Sometimes, we will see both the original creditor (Discover, Capital One,… (Read more)

3 reasons to pull your credit reports after being sued

3 reasons to pull your credit reports after being sued At the time of this article until April 2021, you can pull your credit reports for free every week through AnnualCreditReport.com. In this article, we discuss why you should do this regularly throughout your lawsuit. Print these to PDF, save them on your computer. Then look at them and check for errors. There are three time periods we want to look at your credit reports on compared to the lawsuit:… (Read more)

Suing your mortgage company for refusing to give you a CARES Act forbearance you were entitled to receive

The CARES Act is a powerful law that, if you qualify, entitles you to receive a forbearance on making payments on your mortgage. But what happens when your mortgage company refuses to give you the forbearance? What can you sue for? This is a question that was asked by a consumer after our article listed above. So here are some possibilities: FDCPA RESPA and RESPA letters FCRA State law Let’s look at these but first let’s remind ourselves of what the… (Read more)

What is a furnisher of information to my credit report?

“What is a furnisher of information to my credit report?” You’re looking at your credit reports, and you realize that there’s some false information on there. So you do some research, and you find out about the FCRA (Fair Credit Reporting Act). While you’re looking at the FCRA, you learn about the credit bureaus and agencies, like Equifax, Experian, TransUnion, etc. They collect all this information and put it into a report. Then you read about this person that’s called… (Read more)

Why checking your credit reports before and after a foreclosure is vital

Why checking your credit reports before and after a foreclosure is vital A large part of our practice at Watts & Herring is helping people who are facing foreclosure in the state of Alabama. In addition, we help consumers with credit reporting errors. Are these two practice areas completely separate, or do they merge together from time to time? Sometimes they merge. This is why we recommend checking your credit reports whether you’re facing a foreclosure, or you’ve just gone… (Read more)

What should I do if I win my lawsuit against an original creditor, but credit reports aren’t fixed?

“What should I do if I win my lawsuit against an original creditor, but credit reports aren’t fixed?” Let’s say that you’ve already won your case, and you go the credit company and let them know that you don’t owe the debt on your credit report. You ask them to fix your reports so that your reports will be accurate, and they don’t do it. They reach out to Capital One (or whoever the original creditor is) and ask them… (Read more)

Why should I pull my credit reports when I’m dealing with a foreclosure?

When you’re facing foreclosure, we recommend that you pull your credit reports. This confuses people, and they ask, “Why in the world should I do that? I’ve got a foreclosure that’s happening in two weeks! How is that going to help me?” Well, there are a couple of ways it will help you. It may give you information that shows the foreclosure isn’t allowed. You may also see information that violates other laws, such as the FCRA, Fair Credit Reporting… (Read more)

Is it legal to credit report me as 30 days late before I am actually 30 days late?

Is it legal to credit report me as 30 days late before I am actually 30 days late? Let’s say your payment is due on October 1st, and you pay it on the 2nd instead. Can they report you being 30 days late, which is negative on your credit report? Well, I think it’s pretty clear that no, they can’t. Reporting that someone is 30 days late is exactly that, the person being 30 days late. If you paid it… (Read more)

How will I know that the credit bureaus will fix my reports?

How will I know that the credit bureaus will fix my reports? So you’re looking at your credit reports, and you have an error on them. You send a dispute letter to the credit bureaus, and now you’re wondering how you’ll know if they have fixed it. First off, I’d like to say that almost all disputes should be done by certified mail. That way you get the green card back and you can use the postal code to find… (Read more)

What do I do if the credit bureau says my dispute is frivolous?

Let’s talk about this frustrating situation. You’re dealing with false credit information, and you reach out to the credit bureaus and ask them to fix your reports. They respond by saying, “We deem you to have made a frivolous dispute. Therefore we will not investigate or change it.” Now you’re wondering, “What can I do?” This is frustrating to deal with, assuming your dispute isn’t actually frivolous (if it actually is frivolous, well…). Your legitimate claim is ignored because the… (Read more)

How do I make sure my credit reports are correct after settling with an Original Creditor?

“How do I make sure my credit reports are correct after settling with an Original Creditor?” Let’s say that you were sued for $5,000, and you agree to pay $3,000 to settle the case. Then, after you pay the money and the case is settled with prejudice, you check your credit reports and see that you owe $5,000. What?!?! That simply isn’t true, because you settled with the original creditor. You owe nothing so your credit report should say “zero… (Read more)

Is a verbal dispute to the credit bureaus good enough to fix false credit reporting?

Is a verbal dispute to the credit bureaus good enough to fix false credit reporting? I’d like to chat with you about whether or not it’s a good enough to just call Experian, TransUnion, Equifax, etc. when you’re dealing with false credit reporting. My answer is a big, “Maybe.” It might fix your credit reports. I’m skeptical of how well it works. You can call them and make detailed notes on that call, or maybe even record the call. But… (Read more)

What is a removal of my case from state court to federal court?

What is a removal of my case from state court to federal court? This is where a state case is moved (“removed”) to federal court. So the case literally started in state court and now is transferred to federal court. That’s basically what this means. This is the right of a defendant who is sued in state court if one of two things has happened. The first situation is when there’s a federal claim involved. Let’s say you sue an… (Read more)

Should I use the FDCPA or FCRA when a debt collector has false credit reporting on me?

“Should I use the FDCPA or FCRA when a debt collector has false credit reporting on me?” This is a good question. You can actually use either of them, or in some cases you can use both. Under the FDCPA (Fair Debt Collection Practices Act) you can sue a debt collector without disputing with the credit reporting agencies. However, you may want to try disputing through the credit reporting agencies so that you can use the FCRA also. The FDCPA… (Read more)

Can I fix credit report errors on my own?

“Can I fix credit report errors on my own?” This is a common question that we run across, but a great one nonetheless. Absolutely, you can fix credit report errors on your own. Most of the time, it’s pretty easy to fix them. The key is to properly dispute with the credit reporting agency (Experian, TransUnion, Equifax, etc.) Some people don’t go about it the right way, which can be a mess. Write them a letter. Explain why your credit… (Read more)

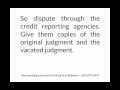

If I have a vacated judgment, what happens with my credit report?

If I have a vacated judgment, what happens with my credit report? This is a great question, especially when we’re dealing with credit reporting agencies. Here are a few words of advice when you’re dealing with a vacated judgment. Check your credit reports. More than likely, the judgment is on your credit report. If it isn’t, then that’s good. It should not be on your reports. There’s nothing that needs to be done. But if the judgment is still on… (Read more)

How do I know if I have any errors on my credit reports?

How do I know if I have any errors on my credit reports? This is a great question. The answer requires some work on your part. But it is definitely worth the effort! Print your credit reports and check everything. You literally need to print your reports off, we recommend getting them for free at AnnualCreditReport.com, and look at them line by line. Check the names, addresses, public listings, etc. Look for things such as bankruptcies, judgments, tax liens. The… (Read more)

My judgment has been satisfied, what does this mean for my credit reports?

My judgment has been satisfied, what happens with my credit reports? When we’re dealing with credit reports, questions about how to deal with judgments arise. Specifically, what it means to have a satisfied judgment. First of all, check your credit reports. When a judgment has been satisfied, the debt is no longer owed. This means that if it is on your credit reports, it should show a zero balance. If there’s no judgment on your report, then you should leave… (Read more)

What damages can I get if I sue under the FCRA for false credit reporting?

What damages can I get if I sue under the FCRA for false credit reporting? Let’s look at the four types of damages you can get under the FCRA (Fair Credit Reporting Act) related to false information on your credit reports. 1. Actual or compensatory damages. This is where we evaluate what actual damages need to be compensated. Let’s say that, if you had no false credit reporting, your interest rate would be 4% instead of 8%. That’s a damage… (Read more)

Should I keep a signed copy of any letter I send to a debt collector?

Should I keep a signed copy of any letter I send to a debt collector? This is a question that comes up when we’re dealing with debt collectors. Yes, you should keep a signed copy. We want to have proof of what we’ve sent to them. In this article, we’re just talking about whether or not to keep a signed copy, not how to send it to the collector. Let’s look at a few reasons to keep a signed copy.… (Read more)

What is the Statute of Limitations in a FCRA lawsuit?

There are times where it is appropriate to sue companies under the FCRA, the Fair Credit Reporting Act, for false credit reporting. We may wonder, “If I can do this, what’s the statute of limitations for an FCRA lawsuit?” (The statute of limitations being the time you have to sue). In general, the statute of limitations is 2 years to sue from when the company violates the law. Of course, there are exceptions to this rule. The second the company… (Read more)

If I’ve settled with the original creditor in Alabama, what should I do with my credit reports?

Great news — you’ve settled your debt collection lawsuit with an original creditor. You may wonder, “What should I be do with my credit reports now?” Generally, consumers think that since they’ve settle with the original creditor, the company will remove the debt from your credit report. Unfortunately, this is not correct. But often creditors don’t accurately report on our credit reports. For example, since we now owe the creditor nothing or $0.00, then our credit report should state that.… (Read more)

“What should I do if the debt collector lies about removing false credit reporting?”

The main reason debt collectors are sued is the fact that they lie to consumers. Let’s say that a debt collector sends us a letter, and it says we owe $3,000, but they’ll cut us a deal and we will only have to pay a $1,500 to settle the deb. That may be a good deal. But we tell the debt collector, “Hey, this needs to come off of my credit report too.” They’ll either call us on the phone,… (Read more)

What is a 1692e(8) FDCPA violation against debt collectors for false credit reporting?

In Alabama, there’s a problem with debt collectors who knowingly put false information on to consumers’ credit reports which violates Section 1692e8 (sometimes written as 1692e(8)) of the FDCPA (Fair Debt Collection Practices Act). There are also debt collectors who may claim to not know that they’re reporting falsely, but if they had common sense they would know that what they’re reporting isn’t accurate. Section 1692e(8) also prohibits this type of bad conduct. A 1692e(8) violation under the FDCPA allows… (Read more)

“How do I settle an old judgment in Alabama?”

If you have a judgment against you from a long time ago, you may wonder, “Is there any way I can settle this old judgment?” It’s really a 3 step process to settle an old judgment in Alabama. Step 1: Negotiate a settlement. You can either hire a lawyer or you can do this on your own. Normally, it will be a lump sum settlement that you will pay. And you should get a discount off of what you currently… (Read more)

What is a motion to enforce a settlement agreement?

“What is a motion to enforce a settlement agreement?” A motion to enforce a settlement agreement is where we are asking a court to enforce the terms of a settlement — to make the defendant do what the defendant promised when it settled. A case gets settled and sometimes we don’t have the settlement agreement already finalized. Or we do and the company we have sued wants to add terms and conditions that we never agreed to. The most common… (Read more)

Does the debt buyer own the debt that they credit report?

“Does the debt buyer own the debt that they credit report?” If you’ve been sued by a debt buyer, or collector, such as Asset Acceptance, Cascade Capital, Midland Funding, LVNV, Velocity, or any other company like this, you may have several questions that come to mind. One question may be, “If the debt buyer is reporting this debt on my credit report, does that prove that they own it?” Absolutely not. It just proves that the debt buyer reported on… (Read more)

Lawsuit against Equifax and Kay Jewelers saying you are dead

Lawsuit against Equifax and Kay Jewelers saying you are dead We have filed many federal court lawsuits against credit reporting agencies (Equifax, Experian, TransUnion, etc) for false credit reporting under the FCRA (Fair Credit Reporting Act). This one (and similar ones we have filed) is one of the most unusual as Equifax and Kay Jewelers (Sterling Jeweler) said our client was dead when he was actually alive. Seems pretty simple to solve, right? Apparently, this is too complicated for these… (Read more)

Can I use the FDCPA if a debt collector is falsely reporting on me?

“Can I use the FDCPA if a debt collector is falsely reporting on me?” You may be dealing with a debt collector who puts false information on your credit report, and one question that you may have is, “Can I use the FDCPA to stop this?” The answer is yes, you can use the FDCPA. You can definitely use this law (Fair Debt Collection Practices Act) to help you. When a debt collector is falsely reporting on you, there are… (Read more)

What is a merged file, and how does this differ from identity theft?

“What is a merged file, and how does this differ from identity theft?” You may have figured out that there’s false information on your credit report, and wondered if you’re dealing with identity theft. You may actually be dealing with a mixed/merged file. A merged file, also know as a mixed file, is where your credit report gets mixed with someone else’s report. Imagine that your report is in an envelope and someone else’s report is in another envelope. Both… (Read more)

Can I really beat a credit reporting agency?

“Can I really beat a credit reporting agency?” Sometimes credit reporting companies like Experian, Equifax, and TransUnion will put false credit reporting information on your account. Then, they refuse to take it off of your report even when you dispute it. When this happens, you may wonder, “Am I stuck with this on my report? Is there anything that can be done to fix this?” As a Consumer Protection Attorney, I’m here to tell you that yes, you can beat… (Read more)

If I sue a credit reporting agency under the FCRA, will they pay attention?

When you’re dealing with a credit reporting agency, you may wonder, “If I sue a credit reporting agency (such as Equifax, Experian, TransUnion) under the FCRA (Fair Credit Reporting Act), will it grab their attention?” Yes, it definitely will get their attention to sue them under the FCRA in Federal Court. This doesn’t mean that you will automatically be successful, because you have to follow the rules, and your case needs to have enough support for your position. When they… (Read more)

The Scorpion and the Frog– why do abusive companies break the law?

This is a little different from our usual posts, however, I believe this story will be beneficial to you as you deal with abusive companies. The Scorpion and the Frog This story has application to debt collectors, credit reporting agencies, car finance companies, mortgage companies, etc. Sometimes we sit and wonder, “Why do these companies do these dumb things where they’ll have to pay a lot of money after we sue them?” Read the story of the scorpion and the… (Read more)

Four Steps to Fixing Identity Theft in Alabama

Identity theft is a huge concern for all of us. We don’t want to be denied a job or security clearance because there are accounts in your name that aren’t yours. It’s one thing to have negative account that is yours, but it is something else if you have a dozen negative accounts that you don’t own. That’s something you don’t want. Even if they’re positive accounts, which happens occasionally, it’s not your account. You may be wondering, “Well, what… (Read more)

How do I fix credit report errors when they come up?

Often times when there’s an issue with your credit report, you wonder, “How can I fix this?” The first step is to pull your credit reports You can go to AnnualCreditReport.com and pull them there for free. Then, you need to look at your credit reports Are they correct? Are there any errors? Sometimes the errors are small, such as having the wrong address. Other times, the error is rather large, such having a $500,000 dollar mortgage that’s late, and… (Read more)

Why do I need to pull my credit reports now?

You must figure out your “current location” If you use your phone or a GPS, it has to figure out your current location before it can tell you how do you get to wherever you want to go. If you want to go to Atlanta, it makes a difference to know where you are right now. Are you in Birmingham, Savannah, New York, or Miami? That current location is going to fundamentally change how you get to Atlanta. In the… (Read more)

Case study– suing Bank of America, Experian, and TransUnion under FCRA for false credit reporting

Summary of the case Bank of America forecloses They foreclosed on our client. Bank of America sues for eviction or “ejectment” This happens after the foreclosure to force you out of your home. Consumer counter sues for wrongful foreclosure, including breach of contract Along with some other claims all related to the wrongful foreclosure. No money was owed to Bank of America after the foreclosure Because they were fully paid in the foreclosure sale. Lawsuit and counterclaims were resolved The… (Read more)

What happens next after you win your collection suit at trial?

First off, congratulations! Most people do nothing when they’re sued. You took action, and answered the collection suit. You showed up at court, and you won your case. Now is the time to finish the good work you have started. Some people may say, “Well, I’ve won my case, so it’s over.” No, you’re about halfway done, so you need to finish the deal. Look into suing the debt collector. I suggest you look into suing the debt collector who… (Read more)

How do I settle a collection lawsuit without hiring a lawyer?

“How do I settle a collection lawsuit without hiring a lawyer?” Remember you have 5 options when sued by a debt collector (debt buyer) such as LVNV, Midland, Portfolio, etc. File bankruptcy Fight the case on your own Settle the case on your own Hire a lawyer to fight the case Hire a lawyer to settle the case So let’s talk about option three — settling the case on your own. (I’m assuming you know to file your answer to… (Read more)

I got sued and suit was dismissed without prejudice. What does this mean for my credit report?

What is a dismissal with prejudice and a dismissal without prejudice? A dismissal with prejudice means the case is over. That could be because you settled, or it could be because they realize they can’t prove their case and they just drop the case. With prejudice means they cannot sue you again. We have a situation right now where a case was won by a consumer but the debt buyer Main Street Acquisitions sued our client again on the same… (Read more)

What do I do if Nationstar is showing up on my credit report but I don’t have a mortgage in my name. It’s in my spouse’s name only.

“What do I do if Nationstar is showing up on my credit report but I don’t have a mortgage in my name. It’s in my spouse’s name only.” This is something that we see quite often. It’s when a mortgage company, for example, NationStar, gets a loan and they will start collecting against you even if you are not on the loan. I’ll use myself as an example. If my wife is the only one on the note, the note… (Read more)

What do I do if I have paid a medical bill, but it gets turned over to a debt collector and ends up on my credit report?

“What do I do if I have paid a medical bill, but it gets turned over to a debt collector and ends up on my credit report?” First of all, if you paid the bill and then it goes to a collector, that shouldn’t happen because there’s nothing to send to the collector. We don’t send zero dollar bills to a debt collector. So if it has gone to a collector, then something has gone wrong and it may very… (Read more)

If a debt collector credit reports inaccurate information, can the collector be held accountable?

“If a debt collector credit reports inaccurate information, can the collector be held accountable?” The short answer is yes. There are two laws involved in false credit reporting by a debt collector: the Fair Debt Collection Practices Act and the Fair Credit Reporting Act. If a debt collector knows or should know that he is reporting false information, he violates the FDCPA (Fair Debt Collection Practices Act). The FDCPA only applies if the collector is subject to this law. Three… (Read more)

4 simple steps to fixing your ID theft credit report problems

ID theft can be very frustrating and people will struggle with fixing it for years. Actually, you can fix it very quickly if you will follow these four steps. The four steps Fill out an ID theft affidavit Get a police report Send a dispute letter If not fixed, then sue in federal court Step one — ID theft affidavit Fill out an ID theft affidavit which you can get from the FTC here. This is a sworn statement that… (Read more)

Why Must The Debt Collector Take Debt Off My Credit Report After I Win The Collection Case

“Why Must The Debt Collector Take Debt Off My Credit Report After I Win The Collection Case?” Hundreds of collection lawsuits are filed by debt collectors (debt buyers) such as LVNV, Midland, Portfolio, etc. but most (if not all) are filed without any proof so it is common for folks to win their collection case. I assume this happened with your collection case since you are reading this. Two important points before we get into the details: First, congrats! You… (Read more)

What is the FCRA (Fair Credit Reporting Act)?

“What is the FCRA (Fair Credit Reporting Act)?” If you have done any research on fixing credit reporting problems, then you will have heard of the law called the FCRA (Fair Credit Reporting Act) which protects you from false credit reporting. It governs credit reporting agencies (Equifax, Experian, and Transunion). The FCRA controls “furnishers” which are those companies that actually provide (or furnish) information to the credit reporting agencies. These include companies such as: Capital One Chase Discover LVNV Funding… (Read more)

How do I stop Asset Acceptance from computer calling me on my cell phone after I beat them at trial?

“How do I stop Asset Acceptance from computer calling me on my cell phone after I beat them at trial?” We had a question from a website visitor about Asset Acceptance, a debt buyer (debt collector), who sued the consumer and lost. But it is still calling the consumer’s cell phone, spouse’s cell phone, and even the consumer’s child’s cell phone. To show it has no concern for the rights of the consumer, Asset Acceptance is credit reporting the account… (Read more)

Why You Need To Pull Your Credit Reports Now

We often talk about credit reports and it seems like a good idea to do. Someday. Here’s why you should do it NOW. You simply have no idea what is on your credit reports (good or bad) until you look at them. Sometimes folks say “My reports are terrible so I don’t want to look at them.” I don’t know — maybe or maybe not. You need to look at them. Other times, folks say “My reports are so awesome… (Read more)

“Can I hold a debt collector responsible for putting false information on my credit reports especially when it lowers my credit score?”

“Can I hold a debt collector responsible for putting false information on my credit report especially when it lowers my credit score?” Having false information on your credit report is very frustrating. Especially when it is from a debt collector who has damaged your credit reports and scores. You have some options on how to fix this problem and hold the debt collector responsible. Use the Fair Credit Reporting Act (FCRA) to fix your credit report Any company, including a… (Read more)

“How do I get my Innovis credit report for free?”

“How do I get my Innovis credit report for free?” Innovis is sometimes called the “4th credit bureau” after Equifax, Experian, and Trans Union. Just like those agencies, you are entitled to a free copy of your credit report from Innovis every 12 months. (Look at this article and video to find out how to get your Equifax, Experian and TransUnion reports for free). You can go directly here to order your free Innovis credit report by mail or by… (Read more)

Re-Aging: One of Debt Collectors Dirty Tricks on Your Credit Report

Re-Aging: One of Debt Collectors Dirty Tricks on Your Credit Report We previously described 5 of the more common dirty tricks that debt collectors commit against your credit reports. “Re-Aging” is where the collector lies so that the account (or “tradeline”) will stay on your report longer than it should. Negative accounts generally stay on for about 7 years after you default. But sometimes debt collectors will say the account just went into default to get the 7 years to… (Read more)

Why Should I Look At My Credit Reports Once A Year?

Why Should I Look At My Credit Reports Once A Year? Let’s talk about this. Credit reports are adult report cards These reports are like report cards for adults. People and companies judge us by our credit reports — fairly or unfairly. So we need to make sure that our credit reports are accurate and truthful. Must pull your reports to see if they are accurate The only way to do this is to pull our credit reports at least… (Read more)

How Do I Pull My Credit Reports For Free In The State Of Alabama?

How Do I Pull My Credit Reports For Free in Alabama? You know you should pull your credit reports — it is critical to find out if there are errors, if there are errors then dispute them, so that you can have an accurate credit report. But how do you pull your reports for free? Avoid the scams and the traps set by the credit reporting agencies. Instead, you can pull your real official reports once every 12 months by… (Read more)

If One Collector Sells A Debt To Another, Will It Stay On My Credit Report Longer?

If One Collector Sells A Debt To Another, Will It Stay On My Credit Report Longer? Time period to stay on your report is 7 years from default regardless of who owns the debt. No. The time period for an account to stay on your credit report is 7 years after you default. This is dictated by the FCRA (Fair Credit Reporting Act). Selling the debt does nothing to change this law. Sometimes debt collectors (debt buyers) will claim to… (Read more)

5 Dirty Tricks Debt Collectors Use On Your Credit Reports

5 Dirty Tricks Alabama Debt Collectors Use On Your Credit Reports. Debt collectors love to mis-use the incredible power of credit reporting in order to force you to pay them and the abusive ones don’t mind breaking the law to do so. There are five common dirty tricks related to credit reports that collectors enjoy using. We’ll list these out and then in separate articles we will take them one at a time. Re-aging the debt; Sue you and lose… (Read more)

Why Do Consumer Protection Statutes Have “Fee Shifting” To Help Consumers under the FDCPA?

Why Do Consumer Protection Statutes Have “Fee Shifting” To Help Consumers under the FDCPA? The short answer is that it allows you, as a consumer, to hire a competent lawyer even if you can’t afford to spend $10,000 or $100,000 on a skilled lawyer. The additional reason is that it is a wonderful motivator for abusive debt collectors (Fair Debt Collection Practices Act)n and credit reporting agencies (Fair Credit Reporting Act) and the companies that furnish false credit reporting information… (Read more)

Time Limit For Debt Collector To Credit Report

“What Is The Time Limit For Collectors To Credit Report In Alabama?” Debt collectors love to threaten to (and actually do) credit report collection accounts on your credit reports. This has a terrible negative impact on your credit reports. So, how long can a collection account be reported on your credit reports? We have previously discussed the general time limits for collecting. And how long a debt collector (debt buyer) has to sue you in Alabama. But today we will… (Read more)

Three Time Periods For Collectors To Collect Debts

Three Time Periods For Collectors To Collect Debts. Alabama consumers often ask “How long can the collection agency collect against me and what is the Statute of Limitations on credit reporting and suing?” This question actually touches on three separate time limits. First, a collector generally has three to six years to sue you. This is the statute of limitations. Also, to be precise, a collection agency must actually own the debt to sue you. Second, a collector can report… (Read more)

I’m Nervous About Giving A Deposition — Is This Normal?

“I’m Nervous About Giving A Deposition — Is This Normal?” Yes, it is normal to be concerned when your deposition has been scheduled. Let’s first talk about what a deposition is and then we’ll talk about what to do in one. If you are even thinking about one, it means you are in a lawsuit. Or you are about to be in a lawsuit. What is a deposition? A deposition is when you will be questioned by the lawyers on… (Read more)

Fixing Credit Report Errors: Who Do You Send A Dispute Letter To?

Fixing Credit Report Errors: Who Do You Send A Dispute Letter To? You have an error on your credit report. You need it fixed. Who do you send your dispute letter to in order to repair your credit report errors? It makes sense to dispute directly with the company providing the false information to the credit reporting agencies, right? It does but this will get you no-where. Legally the furnisher of the information (unless a debt collector) has no obligation… (Read more)

Turn The Collection Lawsuit Into A Suit Against The Debt Collector

Turn The Collection Lawsuit Into A Suit Against The Debt Collector. You’ve been sued by a debt collector (debt buyer) like Asset Acceptance, LVNV, Midland or Portfolio Recovery. You know that you don’t owe any money to the debt buyer and you know the debt buyer normally either can’t or won’t prove it owns the debt. Do you just have to accept that you have sued by some bogus debt collector? Or is there anything that you can do about… (Read more)

Why Collectors Hate To Mark Your Account As “Disputed” On Credit Reports

Why Collectors Hate To Mark Your Account As “Disputed” On Credit Reports We previously wrote about how collectors must mark your account as “disputed” on your credit reports when you dispute it. But why don’t the debt collectors want to do this? There Is Only One Reason Debt Collectors Credit Report. Collectors will act pious and say they owe some obligation to creditors around the world to report you as being in collection. That’s complete garbage. The only reason collectors… (Read more)

If You Dispute A Debt, The Collector Must Mark It As “Disputed” On Your Credit Report

If You Dispute A Debt, The Collector Must Mark It As “Disputed” On Your Credit Report. Disputing A Collection Debt Can Help Your Credit Report If you dispute a debt to a debt collector, this can be beneficial in several ways. First, it lets the collector know that you are not agreeing to the debt. Note: not disputing does not mean you agree to the debt but sometimes collectors who don’t understand the law think this… Second, if the debt… (Read more)

Simple Dispute Letter To Send To Debt Collectors

Simple Dispute Letter To Send To Debt Collectors We have talked about what to say to debt collectors when on the phone, but what about a “simple” sample letter to debt collectors? There are some very long, and I think very ineffective, letters that are floating around the internet. But used properly, the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA) do give us some useful tools to help collectors understand that should not abuse… (Read more)

Have You Won Your Debt Collection Lawsuit Against LVNV? Now Finish It….

Have You Won Your Debt Collection Lawsuit Against LVNV? Now Finish It…. If you have won your Alabama collection lawsuit that the giant debt buyer LVNV Funding, LLC filed against you, then congratulations but understand that your victory is not complete yet. LVNV may still be illegally collecting against you even though the case was dismissed with prejudice or you received a judgment in your favor. Keep reading to find out more about your rights to make sure LVNV is… (Read more)

Do I need to dispute with the credit agencies if I sue under the FCRA?

“Do I Really Have To Dispute False Credit Information under The FCRA With The Credit Reporting Agencies Before Filing Suit Against The Furnisher?” Yes – With Some Exceptions Let’s deal with the exceptions and get those out of the way first. If a debt collector (debt buyer, collection agency, or collection attorney) reports false information on your credit reports, you can sue under the Fair Debt Collection Practices Act (FDCPA). You can — but don’t always have to — dispute… (Read more)

You Have A Legal Right To Accurate Credit Reports

You Have A Legal Right To Accurate Credit Reports What does my credit report mean? Now is the time to think about your credit report. Your credit report is a snap shot of your credit history at a specific moment in time. This will greatly influence the financial terms you will receive when applying for credit. Your credit report will also influence whether you will keep the credit you already have. And your reports can influence job promotions or even… (Read more)

What Are The Benefits Of Suing Under The Fair Credit Reporting Act (FCRA)?

What Are The Benefits Of Suing Under The Fair Credit Reporting Act (FCRA)? You discovered one or more errors on your credit reports and you have disputed the errors directly with the credit reporting agencies. But the errors still remain. And now you are thinking about suing the credit reporting agencies and the furnisher of the false information. What exactly is the benefit to you of suing under the Fair Credit Reporting Act (FCRA)? First, it is the best way… (Read more)

“Should I pay a debt I don’t owe to get it off of my credit report?”

“Should I pay a debt I don’t owe to get it off of my credit report?” No, you shouldn’t pay it just so it will be removed from your credit report. That’s blackmail. If you don’t owe the debt then you should not pay it off. There is a cheaper, and better, solution. Dispute it under the Fair Credit Reporting Act (FCRA) to the credit reporting agencies – Equifax, Experian, Innovis, and Trans Union – and tell them you do… (Read more)

An Overview of How to Deal with Identity Theft

An Overview of How to Deal with Identity Theft When Alabama consumers suspect or discover that they are victims of identity theft, the natural question that is asked is “What can I do to fix this?” Now often this question comes after very intense emotions of frustration, betrayal, helplessness, and anger. To have your identity stolen is to be violated. And as we will discuss in another article, that betrayal is normally by someone we know. These feelings can last… (Read more)

FAQ About How Your Credit Report Should Show Discharged Accounts After Completing a Chapter Seven Bankruptcy

FAQ About How Your Credit Report Should Show Discharged Accounts After Completing a Chapter Seven Bankruptcy I am thinking about filing bankruptcy – what does a discharge mean? First, a discharge is where you no longer owe the debts that are included in bankruptcy. The creditor cannot ever try and collect the debt from you. You can imagine a wall has come up between you and the creditor and the creditor cannot climb over, around, or under the wall to… (Read more)

Why Debt Buyers Must Delete Credit Reporting When They Lose Their Collection Case Against You

Why Debt Buyers Must Delete Credit Reporting When They Lose Their Collection Case Against You When you are sued by a debt buyer or debt collector, this is a very scary event. Fears of losing . . . fears of being garnished . . . fears of being forced into bankruptcy enter the mind. But when the battle is finally over and the Judge announces “Verdict in favor of the defendant (consumer)” you have great joy. The case is over.… (Read more)

FAQ About Fair Credit Reporting Act (FCRA)

FAQ About Fair Credit Reporting Act (FCRA) Q. What is a credit report? A. A “credit report” is a document that normally contains your personal information (name, date of birth, social security number, address, etc) and information about your credit history such as the credit cards you have, the mortgages you have, and whether you have ever been late or been sent to collection. Q. How do I get a copy of my credit report? A. The easiest way is… (Read more)

Steps for Fixing Your Credit Report Errors

General Overview of the Dispute Process under The Fair Credit Reporting Act (Updated December 4, 2019) Having credit report errors is a frustrating and costly problem, but it can be resolved, one way or the other. We say “one way or the other” because credit report errors will either get fixed with your dispute letter or you can sue for money damages in federal court and the errors will be fixed and you’ll be paid money. Before we jump into… (Read more)

Identity Theft — how to fix it and regain control over your credit reports

Identity Theft — How to Fix It and Regain Control Over Your Credit Reports (Updated December 4, 2019) Identity theft can be a terrible experience,. Attempting to get your life back the way it was can be time-consuming and frustrating IF you do not have the proper strategy. But with the proper strategy, you can fix your credit report with or without litigation. And you can do so relatively quickly as well. Let me explain what I mean after we… (Read more)

If I Win The Debt Collection Lawsuit Against Me, What Happens Next?

If I Win The Debt Collection Lawsuit Against Me, What Happens Next? After Success in a Debt Collection Lawsuit: The Facts Fact: A debt collection lawsuit is essentially a claim that you the consumer owe money to the debt buyer or debt collector who sued you. Fact: If the debt collection lawsuit was dismissed with prejudice or if the judge ruled in your, the final decision is that you do not owe the debt to the debt buyer. All collection… (Read more)

I Got Sued and Won – But It’s Still On My Credit Report

I got sued and won- but it’s still on my credit report – what do I do [Updated May 2021]? Congratulations for winning the debt collection (debt buyer) lawsuit against you — now let’s make sure they are not on your credit report. And if they are, what you can do! Because even after a debt collector has been beaten in court, they often will continue to report to the consumer reporting agencies that you still owe the debt. (These… (Read more)

Incorrect Credit Reporting After Bankruptcy

Incorrect Credit Reporting After Bankruptcy [Updated May 2021] Errors with credit reports after you have filed bankruptcy are very common and you need to fix these errors so that you can get your fresh start after bankruptcy. Otherwise you lose a huge benefit of a bankruptcy discharge if creditors and collectors are allowed to do false credit reporting on you. Your credit score can be wrongfully driven down by errors in your credit report. Fortunately, credit bureaus (such as Equifax,… (Read more)